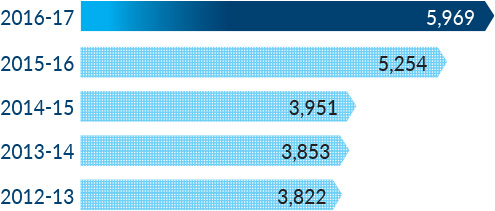

Revenue

12%

FY 2012-13 to FY 2016-17

PAT

07%

FY 2012-13 to FY 2016-17

BOT assets

22%

FY 2012-13 to FY 2016-17

EBITDA

12%

FY 2012-13 to FY 2016-17

Net worth

13%

FY 2012-13 to FY 2016-17

CAGR growth

CAGR growth

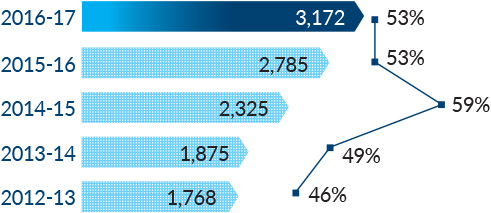

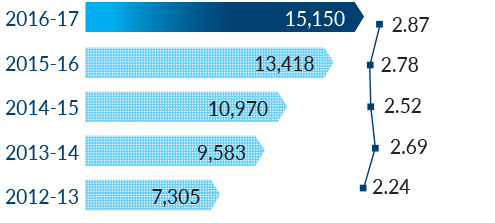

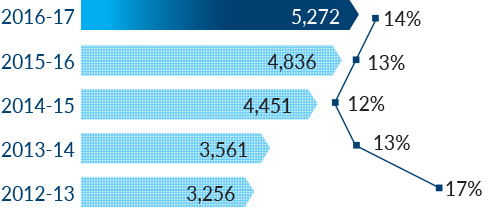

EBITDA (₹Crs) and EBITDA margin (%)

EBITDA margin

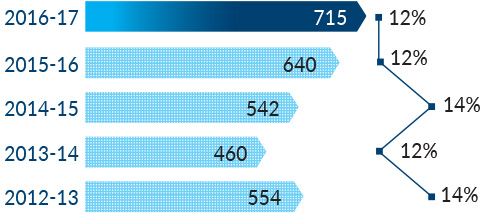

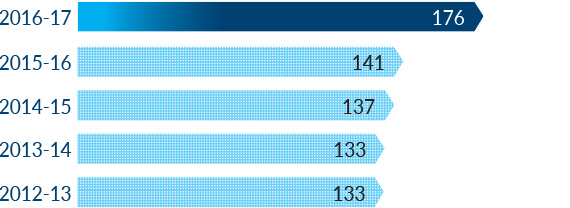

PAT (₹Crs) and PAT margin (%)

PAT margin

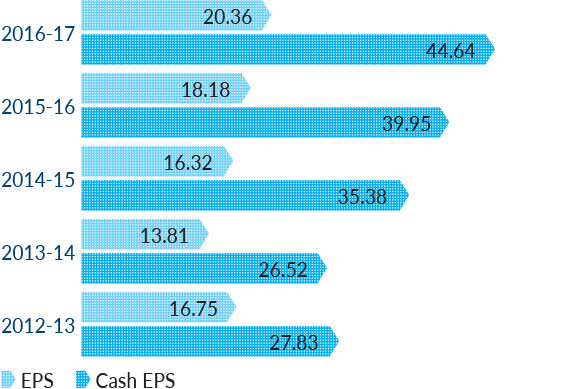

Earnings per share (EPS) and cash EPS (₹)

Increasing number of operational project assets has led to proportional increase in non-cash expenses like depreciation and amortisation resulting in growing cash EPS.

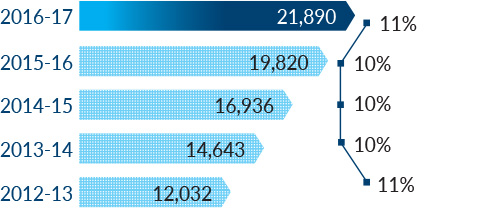

Net debt (₹Crs) & Net debt to equity ratio

Debt:equity ratio

Surging order book position, number of on-going projects and size of projects though contributing to rising revenues has led to increase in debts. However, post the Company’s transfer of six operational assets to IRB InvIT Fund along with its debt component aggregating to ₹3,358 Crs on May 9, 2017, the debt significantly reduced. As on May 30, 2017, the Company's net debt position stood at ₹9,720 Crs, while debt:equity declined to 1.81.

Dividend distributed

The Company has consistently focussed on giving more returns to the shareholders with rising profitability.

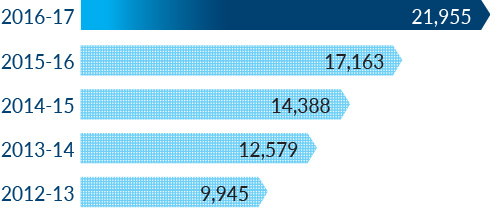

BOT assets

(₹Crs)

Capital employed (₹Crs) & Return on Capital Employed (ROCE) (%)

ROCE

Net worth (₹Crs) & Return on Equity (ROE) (%)

ROE

With an increase in concession period of new awards from 12-15 years earlier to 25-28 years currently, the returns during the initial operational years are comparatively muted.